Warren Buffett said: “Volatility is far from synonymous with risk. It’s natural to consider a company’s balance sheet when looking at its riskiness, as debt is often involved when a company fails. We can see that Digital Turbine, Inc. (NASDAQ:APPS) uses debt in its business. But does this debt worry shareholders?

Why is debt risky?

Debt is a tool to help businesses grow, but if a business is unable to repay its lenders, it exists at their mercy. If things go really bad, lenders can take over the business. However, a more common (but still painful) scenario is that it has to raise new equity at a low price, thereby permanently diluting shareholders. By replacing dilution, however, debt can be a great tool for companies that need capital to invest in growth at high rates of return. The first step when considering a company’s debt levels is to consider its cash and debt together.

What is Digital Turbine’s debt?

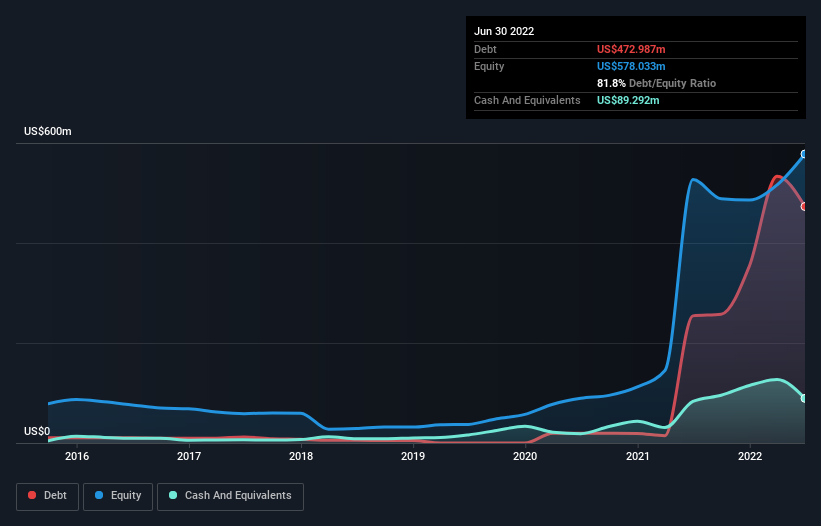

As you can see below, at the end of June 2022, Digital Turbine had a debt of $473.0 million, compared to $254.2 million a year ago. Click on the image for more details. On the other hand, he has $89.3 million in cash, resulting in a net debt of around $383.7 million.

How healthy is Digital Turbine’s balance sheet?

Zooming in on the latest balance sheet data, we can see that Digital Turbine had liabilities of US$316.0 million due within 12 months and liabilities of US$508.0 million due beyond. In return, he had $89.3 million in cash and $257.6 million in receivables due within 12 months. It therefore has liabilities totaling $477.1 million more than its cash and short-term receivables, combined.

This shortfall isn’t that bad because Digital Turbine is worth $1.84 billion and therefore could probably raise enough capital to shore up its balance sheet, should the need arise. But we definitely want to keep our eyes peeled for indications that its debt is too risky.

In order to assess a company’s debt relative to its earnings, we calculate its net debt divided by its earnings before interest, taxes, depreciation and amortization (EBITDA) and its earnings before interest and taxes (EBIT) divided by its expenses. interest (its interest coverage). In this way, we consider both the absolute amount of debt, as well as the interest rates paid on it.

Digital Turbine’s net debt to EBITDA ratio of around 2.1 suggests only moderate debt utilization. And its high interest coverage of 10.5 times makes us even more comfortable. Importantly, Digital Turbine has grown its EBIT by 52% over the last twelve months, and this growth will make it easier to manage its debt. There is no doubt that we learn the most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Digital Turbine’s ability to maintain a healthy balance sheet in the future. So if you are focused on the future, you can check out this free report showing analyst earnings forecasts.

Finally, a company can only repay its debts with cold hard cash, not with book profits. We must therefore clearly examine whether this EBIT generates a corresponding free cash flow. Over the past three years, Digital Turbine has produced strong free cash flow equivalent to 77% of its EBIT, which is what we expected. This cold hard cash allows him to reduce his debt whenever he wants.

Our point of view

Fortunately, Digital Turbine’s impressive EBIT growth rate means it has the upper hand on its debt. And this is only the beginning of good news since its conversion of EBIT into free cash flow is also very pleasing. Looking at the big picture, we think Digital Turbine’s use of debt seems entirely reasonable and that doesn’t worry us. Although debt carries risks, when used wisely, it can also generate a higher return on equity. The balance sheet is clearly the area to focus on when analyzing debt. However, not all investment risks reside on the balance sheet, far from it. For example, we found 5 warning signs for Digital Turbine which you should be aware of before investing here.

In the end, sometimes it’s easier to focus on companies that don’t even need to take on debt. Readers can access a list of growth stocks with no net debt 100% freeat present.

Feedback on this article? Concerned about content? Get in touch with us directly. You can also email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst forecasts only using unbiased methodology and our articles are not intended to be financial advice. It is not a recommendation to buy or sell stocks and does not take into account your objectives or financial situation. Our goal is to bring you targeted long-term analysis based on fundamental data. Note that our analysis may not take into account the latest announcements from price-sensitive companies or qualitative materials. Simply Wall St has no position in the stocks mentioned.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.