What does the digital turbine do?

Digital Turbine, Inc. (NASDAQ: APPS) provides multimedia and mobile communications products and solutions to mobile operators, app advertisers, publishers, original equipment manufacturers (OEMs) and other third parties. The Company also provides programmatic advertising and other professional products and services.

The company recently underwent a major shift in where its revenue is coming from and where its future growth is coming from. The graph below is quite instructive.

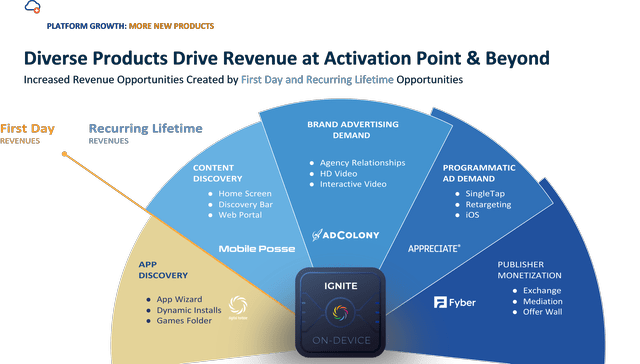

Business investor presentation chart.

Business investor presentation chart.

The legacy business is pre-installing apps on certain phones based on demographics and other data. The software can also collect user feedback and then preload certain apps based on their interests. Clearly this could be lucrative as apps will pay a premium price for this service, but the cap is limited. The software is mainly used on Android devices. These dynamic installs continue to grow, but represent a shrinking share of revenue – less than 30% when the results were last released.

The blue pie slices above are where the business can realize its potential. APPS experienced a wave of acquisitions which immediately contributed to results.

I now want to talk about our recent acquisitions and our strategic game plan. With the acquisitions completed, we have now successfully assembled the key elements of our end-to-end advertising technology platform. I want to spend a minute here to highlight to investors what really differentiates our end-to-end platform from others in the industry. I should start with our overarching mission statement, which is to become the largest independent mobile advertising and monetization platform, leveraging our unique on-device technology and long-term partner in advertising relationships. A few years – a few words here that I want to emphasize, because they represent what sets us apart.

Firstly, having our technology on device, this software presence on highlighted devices gives us distinct advantages, a key one of which is our ability to use our patented SingleTap technology to drive significantly higher conversion rates on the platform. Second, our independence. We have chosen to vertically integrate by functionality unlike many other industry players who have drifted into the content arena, thereby compromising their platform neutrality and posing potential conflicts of interest for others application publishers and advertisers on the platform. Essentially, our on-device technology presence and independent approach makes our platform more attractive to app publishers and advertisers trying to maximize monetization and ROI.

-Bill Stone, CEO on the first quarter 2022 earnings call.

Is the digital turbine profitable?

The SingleTap technology, which is patented, has huge revenue potential. This technology allows users to download apps without going through all the extra steps of using the store. For app developers, this is a huge differentiator to get their apps on as many devices as possible. Samsung, according to Bill Stone, CEO of Digital Turbine, will launch SingleTap worldwide. SingleTap was approximately $24 million in the first quarter of fiscal 2022, compared to less than $2.5 million in the same quarter of fiscal 2021. The On Device Media (ODM) segment as a whole grew 104% year-over-year (YOY) to reach over $120 million in Q1 FY2022. The SingleTap carries a significant risk factor that Google (GOOG) may become hostile to this feature because it bypasses the Google Play Store. Google may want to think twice before being harsh here, as there are several antitrust actions against the company.

Author’s note: APPS operates at the end of the fiscal year on March 31st. Therefore, the first quarter of fiscal 2022 corresponds to the period from April 1, 2021 to June 30, 2021.

With the acquisition of Fyber, the In App Media – Fyber (IAM-F) segment was created. The IAM-F segment offers a platform that allows mobile app makers to monetize their products through ad placement. Revenues from this segment are largely stock-based. For example, per impression or per click. This segment delivered nearly $50 million in the first quarter.

With the acquisition of AdColony, the In App Media – AdColony (IAM-A) segment was created. The IAM-A segment provides, inserts and tracks in-app advertising. This segment generated $45 million in revenue in the first quarter. From these new segments, the Company now realizes revenue from both the supply and demand side of the business.

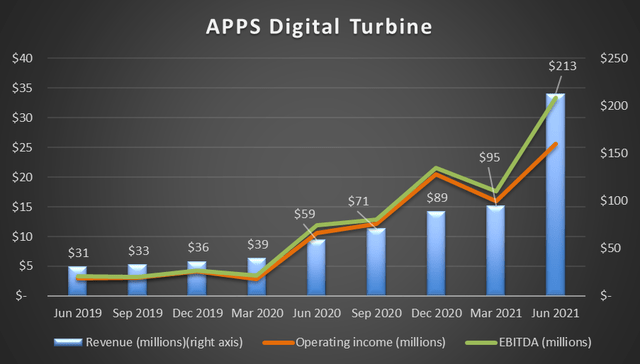

Chart created by author with data from Seeking Alpha.

Chart created by author with data from Seeking Alpha.

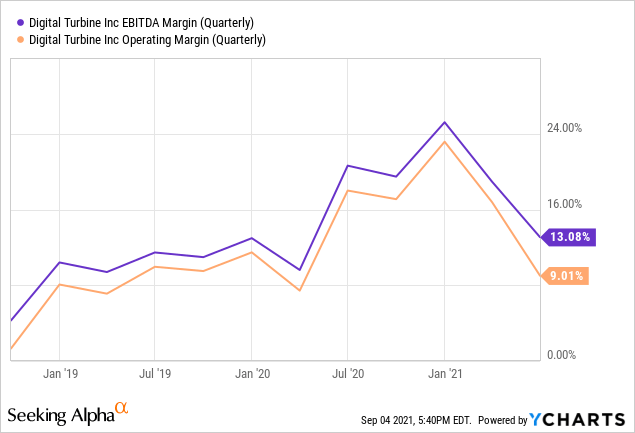

These acquisitions, along with impressive organic growth, have increased revenue, operating profit and EBITDA. Operating profit and EBITDA increased 142% and 181% year-on-year on a 260% increase in revenue.

Acquisitions have a cost, which in this case is long-term debt. The company went from net debt to long-term debt of $233.8 million as of June 30, 2021.

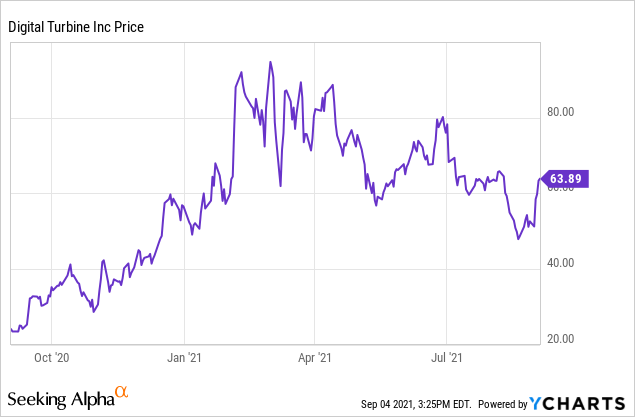

APPS share price

APPS stock has risen significantly over the past year, by more than 164%, but has fallen out of favor recently and is down nearly 30% in the past six months.

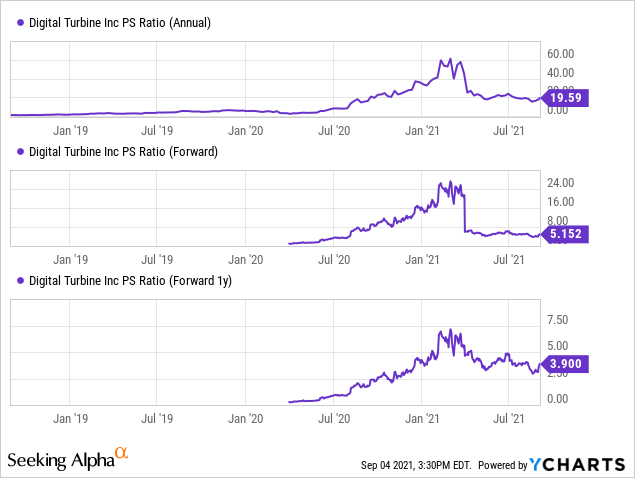

This recent weakness, coupled with improving income metrics, has made valuation metrics much more attractive. Namely, the stock trades at just 5.15x the forward price-to-sales (P/S) ratio.

Is the digital turbine overrated?

As shown below, the company’s P/S metrics on a forward and forward-looking one-year basis are historically lower than at the start of 2021. It looks like investors are factoring in risk, debt and waiting to see how acquisitions will proceed in the future. .

Operating profit margin and EBITDA margin fell in the first quarter of fiscal 2022, likely in part due to increased acquisition-related costs. Investors should expect these to rise in the coming quarters.

The stock is not significantly overvalued based on growth potential and may be quite undervalued given recent performance, provided risks are contained and management can effectively execute acquisition integration.

For the second quarter of fiscal 2022, which ends September 30, 2021, the company expects revenue of $300 million to $306 million. It’s also over 42% higher than fiscal 2022 Q1 revenue, which is pretty impressive.

Is APPS Stock a buy, sell or hold?

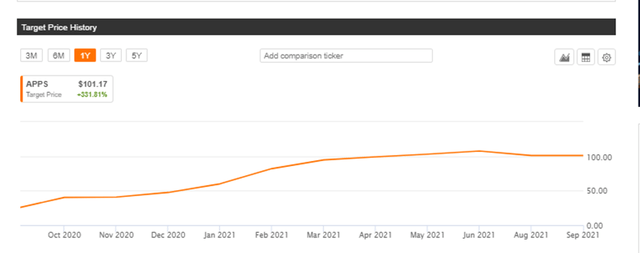

Wall Street has had great success in 2021 with consistently raised price targets. According to Wall Street Ratings analyst Seeking Alpha, analysts are significantly bullish with an analyst rating of 3 very bullish, 2 bullish, and 1 neutral. There are no bearish notes. The average price target is now above $100 per share at $101.17. This implies a massive upside of 58% from the close of 03/09/2021.

Chart of Seeking Alpha.

Chart of Seeking Alpha.

Another bullish sign is the news that APPS stock will be added to the S&P MidCap 400 Index (MDY). This is a positive point for three main reasons.

- Credibility. A company added to an index shows confidence in the company.

- Exposure. Being on a major index makes the stock more recognizable to individuals and institutions.

- Indexed mutual funds that track the MDY are regular buyers of the stock. This creates a base level of demand. Unfortunately for APPS, the MDY is not a widely followed index.

The signs are mostly positive for Digital Turbine and the future looks bright, but the stock has fallen out of favor in recent months. It probably needs a jolt of good news to regain an uptrend. The company has a chance to do so with higher earnings and improved margins in the coming quarters as accretive acquisitions materialize.