VPanteon

Investment thesis

Digital Turbine, Inc. (NASDAQ:APPLICATIONS) continued to underperform by -6.57%, since our previous Hold analysis in June 2022. In the meantime, with the macro economy deteriorating and analysts continually slashing estimates, we expect the stock market to remain bearish a little more. Other software/mar-tech companies such as Microsoft (MSFT) and Selling power (RCMP) both embarked on cost-cutting strategies while laying off workers. Clearly, revenue growth continues to be impacted by the post-reopening cadence. With more companies tightening their belts and rising inflation remaining sticky, APPS’ stock performance could languish further.

There are also minimal recovery catalysts, as the Fed is expected to aggressively raise interest rates through 2023, with 92.3% of analysts projecting a 75 basis point hike in November and probably December as well. The terminal rate can also be increased to more than 5%, beyond the initial projection of 4.6%. Analysts also predict a 100% chance of recession, with the world already in the midst of a deepening geopolitical storm.

Nevertheless, we remain optimistic about the outlook for APPS, due to the ongoing digital transformation following the COVID-19 pandemic. The decline in ad tech spending is only temporarily impacted, with things optimistically looking up by 2024 once the macro economy improves and consumer demand returns. This period of peak pain only gives interested investors an attractive entry point for long-term investments and portfolio growth. The time to add is soon.

Mr. Market continues to be bearish on running APPS Forward

S&P Capital IQ

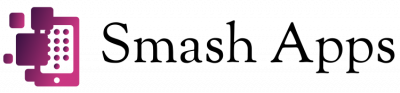

For its upcoming FQ2’23 earnings call, APPS is expected to report revenue of $175.7 million and EBIT margins of 11.3%, indicating notable QoQ declines of -6.83% and -1.7 points. percentage, respectively. Thus impacting its profitability, with net revenues of $34 million and net profit margins of 19.4% for the next quarter. This represents a further decline of -12.14% and -0.9 QoQ percentage points, respectively. As a result, impacting its FQ2’23 EPS by -10.52% QoQ to $0.34.

S&P Capital IQ

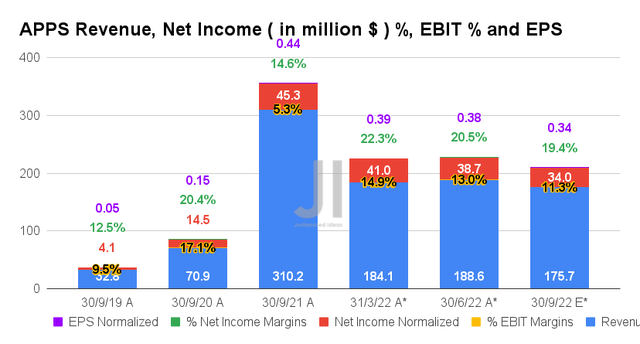

However, APPS investors should not be discouraged as the company is still expected to post improved free cash flow (FCF) generation of $37.9 million and an FCF margin of 21.5% for FQ2′ 23. This is mainly attributed to its reduced capital expenditure and improved synergy of its acquisitions. Thus, potentially indicating an excellent QoQ improvement of 25.49% and 5.5 percentage points, respectively. The company also continues to put its excess capital to good use by paying off $60.5 million of its debt in the first quarter of 2023, indicating a -9.7% moderation in its long-term debt to $472.98 million. dollars.

S&P Capital IQ

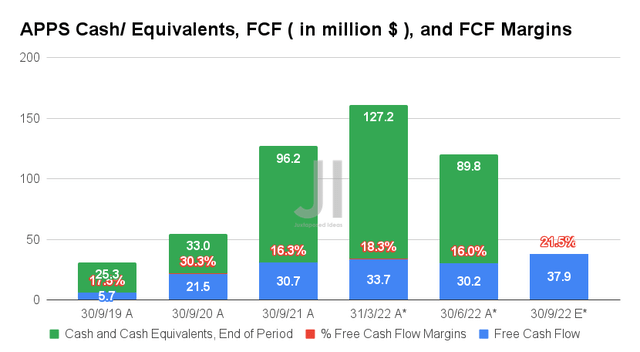

Meanwhile, APPS is expected to experience revenue and net income growth at a slower CAGR of 14.63% and 22.72% over the next two years, respectively, from pandemic levels of 132.15%/ 59.92%. Clearly, Mr. Market is now more bearish than expected, with continued downgrades to its revenue and net income growth of -16.90% and -27.37% since our last analysis in June 2022.

Nevertheless, APPS investors should still note that their margins remain relatively excellent, dropping from 21.17% in previous estimates to 19.6% at the time of writing. This is mainly attributed to the deteriorating macro economy affecting ad spend, rather than its fundamental performance. In the meantime, the company is expected to report fiscal 2023 revenue of $753.88 million and net revenue of $147.95 million, indicating further deterioration of -11.30% and -17.80. % compared to previous estimates. It’s no wonder, then, that the stock continued to underperform after the release of its disappointing orientation forward FQ2’23 in its previous earnings call.

S&P Capital IQ

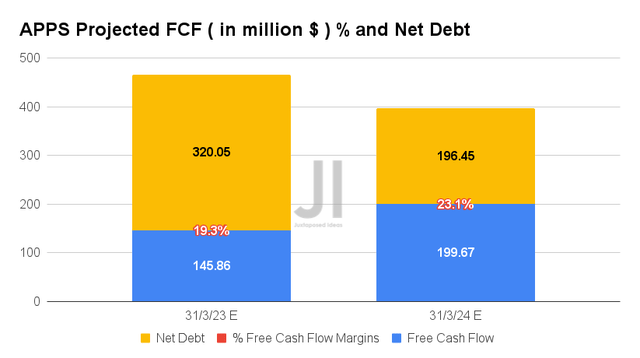

Nevertheless, it is also necessary to underline the dazzling growth of APP’s profitability despite the changes in accounting method, from adj. net income/FCF margins from 12.6%/20.8% in FY20, to 22.8%/8.2% in FY22, and finally to 21%/18.5 % in fiscal 2024. In addition, Mr. Market expects the company to continue its deleveraging efforts of -21.27% in fiscal 2023 and -38.61% in of fiscal 2024, indicating a massive moderation of -50.65% from current levels of $398.15 in net debt. Impressive indeed, given the growth in revenue and net income over the next year.

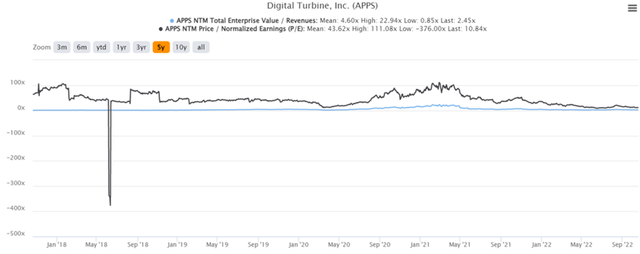

Nevertheless, it is clear that there is still a wide gap with its competitor, such as ironSource (IS), given the forecast profitability of the latter of 29.5%/26.2% at the same time. This explains the difference in their valuations, with IS posting an EV/NTM revenue of 3.43x and a P/E NTM of 14.66x, against APPS at 2.45x and 10.84x, respectively. In the near term, we expect to see further corrections in APP stock valuations as Mr. Market persists in his overly bearish sentiments, with the S&P 500 index already plunging three times below its previous June lows.

In the meantime, we encourage you to read our previous article on APPS which would help you better understand its market position and opportunities.

- digital turbine: 2023 FQ1 performance will be key to its recovery – not an immediate buy

So is APPS Stock a buySell or Keep?

APPS 5Y EV/Revenue and P/E Valuations

S&P Capital IQ

APPS is currently trading at a Revenue EV/NTM of 2.45x and P/E NTM of 10.84x, below its 5-year average of 4.60x and 43.62x, respectively. The stock is also trading at $14.07, down -85.02% from its 52-week high of $93.98, but with a 15.42% premium to its low. 52 weeks at $12.19. Nonetheless, consensus estimates remain bullish on APPS’ prospects, given their price target of $37.33 and a 165.32% upside from current prices.

APPS share price 5 years

Looking for Alpha

However, due to the above factors, we expect APPS to continue to pull back moderately over the next few months as we enter a brutal stock market winter. Therefore, we rate APPS stock as a buy, only at the higher numbers. Even then, investors should size their portfolios accordingly given the potential volatility.