denkcreative

Thesis

Digital Turbine, Inc. (NASDAQ: APPS) the stock fell sharply (around 26%) from its August highs as the market denied further bullish buying after its FQ1’23 earnings release in August.

The company released a mixed Q2 card. While its profitability remains robust, the company sees near-term headwinds on macro-level ad spend. But none of that was surprising, given previous earnings releases from its top digital advertising peers.

Additionally, we believe the market also needed to digest its strong rally from its June lows, as it gained over 70% to its August highs. Therefore, we are confident that the pullback is a healthy retracement, providing patient investors with another opportunity to accumulate at a less aggressive entry level.

We are confident that Digital Turbine’s growth momentum should continue to improve through FY23/24 as cyclical headwinds ease while its structural growth drivers remain intact. Still, headwinds from Chinese smartphone OEMs could continue to weigh on its momentum, given the COVID lockdowns and weak sentiment from major Chinese Android makers. Therefore, investors should not expect a V-shaped recovery for APPS.

Nevertheless, we remain convinced that its valuations have been significantly reduced. We also stand by our thesis that APPS staged its long-term bottom in June.

Accordingly, we reiterate our Buy rating on APPS, with a revised Medium Term (PT) price target of $30, implying 66% upside potential.

Don’t be afraid of the transient slowdown in APPS growth

Management noted in its earnings commentary that ad spend headwinds also affected it. However, this accentuated the fact that Apple’s Application Tracking Transparency (AAPL) and inflation challenges did not significantly impact its performance. Therefore, Digital Turbine remains convinced that its impact is transitory, as CEO Bill Stone explained:

We have seen a slowdown in the digital advertising market as advertisers rethink their investment strategies. This has negatively impacted our recent results and short-term outlook. However, we expect this to be a temporary rather than permanent dynamic. The overwhelming feedback we see in the marketplace is that the majority of advertising consumers are more in wait-and-see mode than in we don’t have the money to spend mode. (Call on Digital Turbine FQ1’23 results)

We are convinced that the cyclical slowdown in advertising spending is not structural. Similar comments from recent Snap (SNAP) and The Trade Desk (TTD) results support Digital Turbine’s view. Therefore, we believe the critical question is whether Digital’s Turbine’s expanded technology stack is able to compete for market share amid the current headwinds.

Therefore, we are delighted that management has shared more colors that SingleTap remains in a growth phase in the current environment. Management stressed that it is on track to accelerate its licensing, as it “plans to have more than five live partners by the end of the September quarter and north of 10 by the September quarter. december”.

Therefore, we are confident that its strategic differentiation through SingleTap remains highly relevant as it continues to expand its partnerships. Additionally, the company is ramping up content media deals with major carriers Verizon (VZ) and AT&T (T) in FY23, leveraging the broader postpaid market from its previous prepaid focus. Accordingly, we believe Digital Turbine’s medium-term structural drivers should point it towards a re-acceleration phase, supported by the subsequent return of cyclical tailwinds in ad spend.

APPS valuations have been significantly reduced

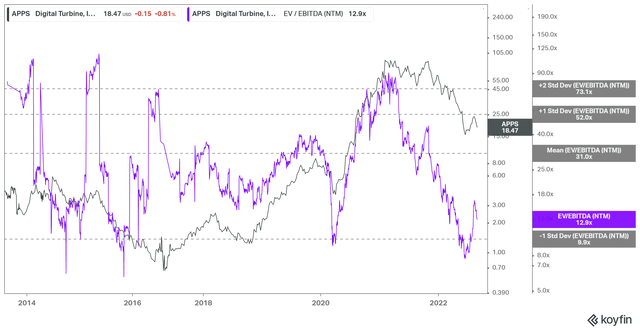

APPS EV/NTM EBITDA valuation trend (koyfin)

APPS was supported in the area of one standard deviation below its 10-year average during its recent June lows. This area had consistently supported APPS over time, including the March 2020 lows.

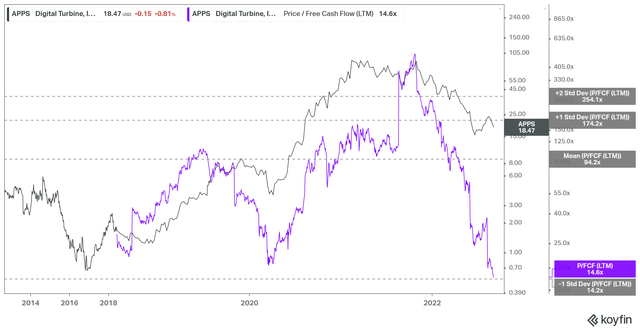

Valuation trend of multiple APPS TTM FCF (koyfin)

Additionally, we also gleaned similar observations from its Free Cash Flow (FCF) TTM multiples, as APPS last traded in the standard deviation zone below its average. As a result, we believe its valuations have been significantly reduced, providing investors with a lower risk entry level.

Is APPS Stock a buy, sell or hold?

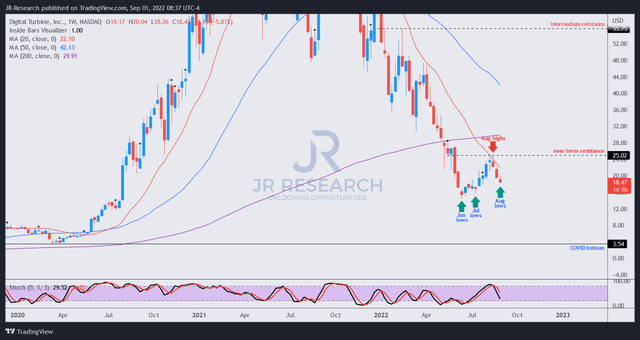

APPS Price Chart (Weekly) (TradingView)

APPS has gained momentum from its June lows as seen above. Notably, it also formed higher lows in July, suggesting an accumulation phase. Despite the recent sharp pullback from its August highs, APPS remains well above its June lows and could also form another higher low by the end of this week.

Therefore, we believe its price action supports our view that downside volatility below the June low is likely limited, providing an attractive risk-reward profile.

We reiterate our purchase note, with a mid-term PT of $30.