Digital turbine – Investment thesis

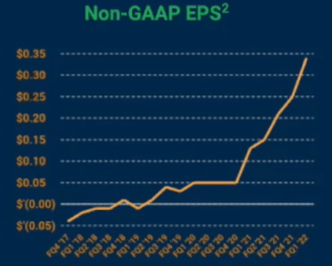

Digital Turbine (NASDAQ: APPS) is a very fast growing mobile advertising platform that is growing at a rapid rate on its revenue. But where he really shines is on his results, where his EPS numbers increase significantly above 100% CAGR. Indeed, unlike countless other fast-growing stocks, Digital Turbine is actually very profitable.

Meanwhile, investors didn’t like that Digital Turbine’s sequential growth for the second quarter of fiscal 2022 pointed to just 5% organic growth, which alarmed investors.

However, I declare that paying 5x this year’s income factors is simply rating way too much pessimism. Here’s why:

Takeaways from the Digital Turbine conference call

Before discussing the underlying dynamics of the orientations, I will highlight the main significant conclusions of yesterday’s conference:

- Digital Turbine has now added more devices in the past 12 months than iPhones (AAPL) sold globally;

- SingleTap, Digital Turbine’s fast-growing product, which is growing 600% annually and is now nearing $100 million in revenue; approximately 8% of its total activity;

- Digital Turbine operating leverage drives EPS numbers above revenue growth (2-Year EPS CAGR of 155%)

(Source)

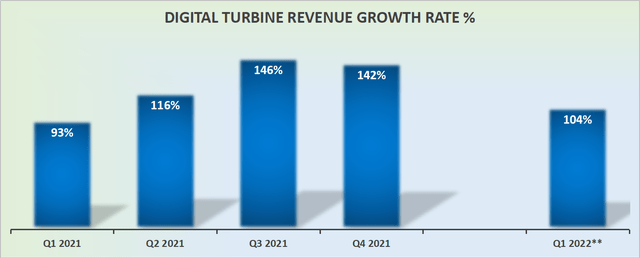

After 3 acquisitions, Digital Turbine’s revenues explode

Source: Author’s calculations; *Q1 2022 figure is pro forma.

A bit of context is needed, Digital Turbine is reporting its Q1 2022 figure as if it already owns its three mid-quarter acquisitions. They also give you the numbers, like they already owned these companies last year.

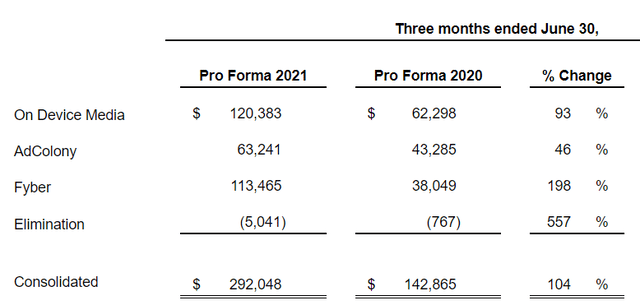

(Source): Note that the table above does not include Appreciate separately, as this is included in the On Device Media segment.

If Digital Turbine hadn’t given you those numbers, revenue would have grown 168% y/y.

That said, to add to the confusion, they did not provide pro forma results in their next quarter guidance. Investors therefore do not know what the real forecasts and sustainable growth rates of Digital Turbine will be in the next quarter.

To illustrate, Digital Turbine guided for $303 million in the middle of next quarter, but that’s because they added those 3 big companies (Appreciate, Fyber, AdColony).

And compared to the same period a year ago, on the ”reported” figure, at mid-term, the guidance would be up 327% y/y. But not everything is organic, because they added these companies, as I noted before.

And that’s why when the company announced its earnings, investors couldn’t fathom how good those results actually were.

Additionally, if we take their pro forma revenue of $292 million reported by Digital Turbine this quarter, and factor in their forecast of $303 million next quarter, that indicates sequential growth of 4%, this which is completely out of line with what investors would have hoped for. to see from a mobile advertising company, in one of the strongest periods of advertising.

Although I’m not investing quarter to quarter, I’ve been investing here for a while, I have to be frank and admit that the indications are partially confusing in comparison to the same period a year ago, as well as , on sequential growth. Simply put, the numbers don’t look that strong compared to other high-growth advertising names.

Diversification at the heart of Digital Turbine’s strategy

Keep in mind that Digital Turbine currently has three companies under its hood, which has overshadowed many of the opportunities Digital Turbine is working on.

A key driver of its future growth rates is increased monetization over the life of the device compared to just monetization upon first activation.

In the past, Digital Turbine’s technology could only serve brands by installing a few apps per new device.

But for now, while still significant, other areas Digital Turbine is moving into are areas such as Content Media, the most promising of which is SingleTap, which is up 600% year-over-year.

SingleTap is when a consumer sees an ad on their device, taps the ad, and gets the app immediately installed on the device, without any friction of having to visit app stores. This is very important for brands as it eliminates friction and increases customer conversion up to 10x.

One of the big concerns investors had about Digital Turbine was its reliance on a single carrier and whether that carrier ended up building a competing product, whether Verizon (VZ) or another, building a platform -form of mobile advertising so that it does not have to generate revenue to share with Digital Turbine, this would significantly undermine Digital Turbine’s growth prospects.

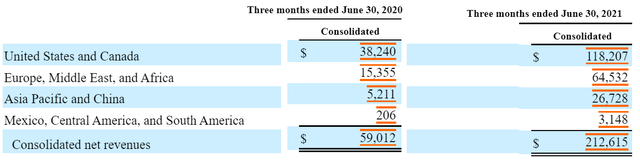

However, based on its acquisitions, as well as Digital Turbine’s own efforts, see below how much more diverse Digital Turbine is now compared to last year.

(Source)

Currently, the United States accounts for 56% of total revenue, compared to 65% in the same period a year ago.

Also during the call, we learned that no customer now represents more than 10% of Digital Turbine’s pro forma revenue.

Valuation – APPS Stock is still ridiculously cheap

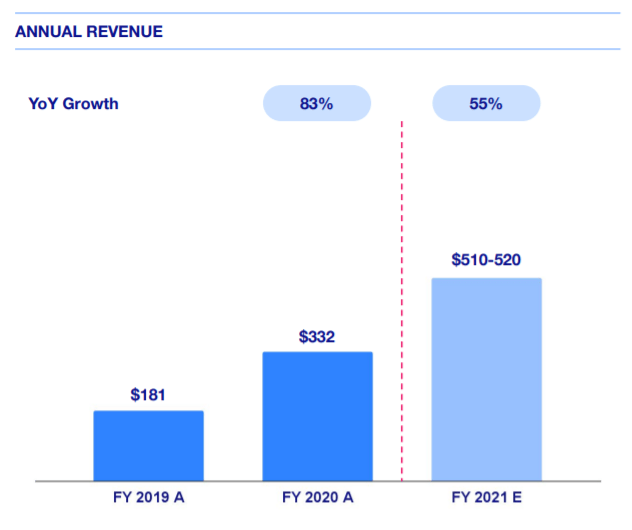

When a business is growing at such a rapid pace, it’s hard to understand what’s possible over time. Right now, without a doubt, Digital Turbine is going to exceed $1.1 billion in revenue for its 2022 fiscal year. This implies that the stock is valued at almost 5 times forward sales.

(Source)

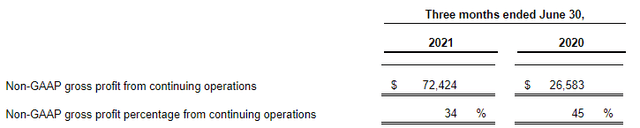

And as I expected, given that its new acquisitions aren’t as profitable as Digital Turbine’s core business, its gross margins have fallen from 45% last year to 34% in the current quarter.

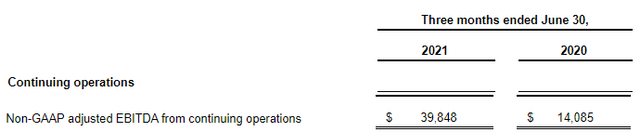

That said, as we continue to drill down its income statement, we can see that, unlike other fast-growing names, Digital Turbine is rapidly increasing its profitability:

(Source)

As you can see here, Digital Turbine EBITDA grew 172% y/y.

Compared to other digital ad companies, there simply aren’t many priced close to 5x revenue that show this level of growth. And that’s part of the problem for investors.

Investors aren’t sure what Digital Turbine’s sustainable growth rates might level off at in the medium term.

Premortem (investment risks)

Digital Turbine’s business model depends on a healthy mobile sales market. If the number of new devices purchased slows, it would impact Digital Turbine’s growth prospects.

Additionally, Apple’s privacy data, IDFA, will continue to be a headwind for Digital Turbine. If Digital Turbine struggles to get enough first-party data from the device, it will reduce its monetization per device and impact its growth rates.

The digital advertising market is very competitive. Not only are there countless ways for advertisers to reach consumers through social media and other platforms, Digital Turbine also has a direct competitor, ironSource (IS).

ironSource is valued at $11 billion and more expensive than Digital Turbine, but ironSource’s 2021 forecast shows less than half of Digital Turbine’s expected revenue at $520 million, compared to more than $1.1 billion for Digital Turbine.

(Source)

This implies that ironSource costs around 21 times this year’s revenue and drops to around 18 times next year’s revenue.

The essential

Digital Turbine is a very exciting company to be a shareholder in. And there is no doubt that Digital Turbine is growing at a very rapid pace. For now, this security remains valued at a very low price at nearly 5 times forward sales.

This low valuation offers investors a very large margin of safety. And given that the stock is now trading near the six-month low price, I think that price is worth buying more.